Jiama Copper Gold Polymetallic Mine

The Jiama project is one of the largest copper gold polymetallic mines in China. The Jiama project is located within the Gangdise Copper Metallogeny Belt in Central Tibet, China and is approximately 60 kilometers east of Lhasa City along the Sichuan-Tibet Highway. The Jiama project is a large scale polymetallic deposit consisting of copper, molybdenum, gold, silver, lead and zinc.

The Company acquired the Jiama project on December 1, 2010 concurrent with the closing of its initial public offering and listing on the Stock Exchange of Hong Kong Limited. Commercial production began at the Jiama project in September 2010.

Phase I development was completed at the Jiama project in 2010 and included two open pits, a processing plant and an underground ore transportation system.

Phase II expansion started commercial production on July 1, 2018. Jiama Mine’s Phase II consists of two series, Series I and Series II, each having a mineral processing capacity of 22,000 tpd. The full design capacity of ore processing at Jiama Mine will increase to 50,000 tpd from the previous capacity of 28,000 tpd once Series II reaches full design capacity.

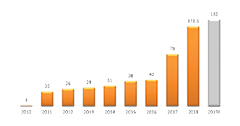

The copper production in 2022 is approximately 187 million pounds (approximately 85,000 tonnes) which was in line with the 2022 production guidance range.

Copper Production

Mining Made Green.

Click Here to take a look at our Social Responsibility Report

Highlights

- Open-pit and underground mines operation

- A large, skarn-type and porphyry copper polymetallic deposit with well-developed hornfels-type mineralization located in the Gangdise Copper Metallogeny Belt

- Principal product: Copper with gold and silver credits

- Expected life of mine: 35 years

- According to the feasibility study, production is expected to grow to 176 million pounds of copper per year when reach full design processing capacity

RECENT UPDATES:

2023 Q1 Financial Performance Snapshot

| Jiama Mine | Three months ended March 31, | |

| 2023 | 2022 | |

| Copper sales (US$ in millions) | 136.58 | 178.67 |

| Realized average price 1(US$) of copper per pound after smelting fee discount | 3.32 | 3.72 |

| Copper produced (tonnes) | 20,025 | 21,923 |

| Copper produced (pounds) | 44,146,826 | 48,332,017 |

| Copper sold (tonnes) | 18,662 | 21,778 |

| Copper sold (pounds) | 41,143,092 | 48,012,990 |

| Gold produced (ounces) | 17,536 | 21,307 |

| Gold sold (ounces) | 17,308 | 21,104 |

| Silver produced (ounces) | 720,142 | 805,743 |

| Silver sold (ounces) | 688,585 | 810,367 |

| Moly produced (tonnes) | 186 | 212 |

| Moly produced (pounds) | 410,787 | 467,861 |

| Moly sold (tonnes) | 178 | 264 |

| Moly sold (pounds) | 392,938 | 583,076 |

| Total production cost 2 (US$) of copper per pound | 2.83 | 3.25 |

| Total production cost 2 (US$) of copper per pound after by-products credits 4 | 1.67 | 2.13 |

| Cash production cost 3(US$) of copper per pound | 2.12 | 2.58 |

| Cash production cost 3 (US$) of copper per pound after by-products credits 4 | 0.96 | 1.46 |

- A discount factor of 13.5% to 24.4% is applied to the copper benchmark price to compensate the refinery costs incurred by the buyers. The discount factor is higher if the grade of copper in copper concentrate is below 18%. The industry standard of copper in copper concentrate is between 18-20%.

- Production costs include expenditures incurred at the mine sites for the activities related to production including mining, processing, mine site G&A and royalties etc.

- Non-IFRS measure. See ‘Non-IFRS measures’ section of this MD&A

- By-products credit refers to the sales of gold, silver, lead, zinc and moly during the corresponding period.

During the three months ended March 31, 2023, the Jiama Mine produced 20,025 tonnes (approximately 44.1 million pounds) of copper, a decrease of 9% compared with the three months ended March 31, 2022 (21,923 tonnes, or 48.3 million pounds).

Total production cost of copper per pound decreased by 13% and cash production cost of copper per pound decreased by 17% due to continuous cost control and the lower price of raw materials, such as electricity and cement, in the first three months of 2023 as compared to the same period in 2022. Total production cost of copper per pound after by-products and cash production cost of copper per pound after by-product decreased in the first three months of 2023 as compared to the same period in 2022 with stable by-product revenue per pound of copper.

Since the second half of 2021, the Jiama Mine increased the utilization rate of low-grade ore with operating costs being strictly controlled. A flexible mining plan was adopted, which is responsive and tailored to the market conditions.

2023 Q1 Production Update

| Jiama Mine | Three months ended March 31, | |

| 2023 | 2022 | |

| Ore processed (tonnes) | 4,236,835 | 4,448,618 |

| Average copper ore grade (%) | 0.56 | 0.58 |

| Copper recovery rate (%) | 85 | 85 |

| Average gold grade (g/t) | 0.20 | 0.22 |

| Gold recovery rate (%) | 63 | 68 |

| Average silver grade (g/t) | 9.42 | 8.90 |

| Silver recovery rate (%) | 56 | 63 |

| Average Moly grade (%) | 0.029 | 0.023 |

| Moly recovery rate (%) | 15.03 | 20.99 |

- During the three months ended March 31, 2023, the metals recovery rates remained consistent for copper, and decreased by 5% for gold and by 7% for silver. There was recovery of molybdenum and no production of lead and zinc during Q1 2023.

Mineral Resources Estimate

Jiama Mine resources by category at December 31, 2022 under NI 43-101:

Jiama Project - Cu, Mo, Pb, Zn ,Au, and Ag Mineral Resources under NI 43-101 Reported at a 0.3% Cu Equivalent Cut off grade*, as of December 31, 2022

| Class | Quantity Mt |

Cu % | Mo % | Pb % | Zn % | Au g/t | Ag g/t | Cu Metal (kt) |

Mo Metal (kt) |

Pb Metal (kt) |

Zn Metal (kt) |

Au Moz | Ag Moz |

| Measured | 91.94 | 0.38 | 0.04 | 0.04 | 0.02 | 0.07 | 5.05 | 350.6 | 33.7 | 33.5 | 16.8 | 0.216 | 14.921 |

| Indicated | 1315.48 | 0.40 | 0.03 | 0.05 | 0.03 | 0.10 | 5.48 | 5216.8 | 451.9 | 613.1 | 380.0 | 4.197 | 232.005 |

| M+I | 1407.42 | 0.40 | 0.03 | 0.05 | 0.03 | 0.10 | 5.46 | 5567.4 | 485.6 | 646.6 | 396.8 | 4.412 | 246.926 |

| Inferred | 406.10 | 0.31 | 0.03 | 0.08 | 0.04 | 0.10 | 5.13 | 1247.0 | 123.0 | 311.0 | 175.0 | 1.317 | 66.926 |

Note: Figures reported are rounded which may result in small tabulation errors.

The prices of Cu, Mo, Pb, Zn, Au and Ag are US$2.9/lbs; US$15.5/lbs; US$2.9/lbs; US$0.95/lbs; US$1,300/oz and $20/oz respectively. The Copper Equivalent basis for the reporting of resources has been compiled on the following basis:

CuEq Grade: = (Ag Grade * Ag Price + Au Grade * Au Price + Cu Grade * Cu Price + Pb Grade * Pb Price + Zn Grade * Zn Price + Mo Grade * Mo Price) / Copper Price

The Mineral Resources include the Mineral Reserves

Resource Estimate by Runge Pincock Minarco on 12th November of 2012 and updated by Gerald Guo, P.Eng, a Qualified Person as defined by NI 43-101.

Mineral Reserves Estimate

Jiama Mine reserves by category at December 31, 2022 under NI 43-101:

Jiama Project Statement of NI 43-101 Mineral Reserve Estimate as of December 31, 2022

| Class | Quantity Mt |

Cu % | Mo % | Pb % | Zn % | Au g/t | Ag g/t | Cu Metal (kt) |

Mo Metal (kt) |

Pb Metal (kt) |

Zn Metal (kt) |

Au Moz | Ag Moz |

| Proven | 17.70 | 0.60 | 0.05 | 0.02 | 0.02 | 0.19 | 7.60 | 105.9 | 8.9 | 4.0 | 2.7 | 0.108 | 4.324 |

| Probable | 341.46 | 0.60 | 0.03 | 0.13 | 0.07 | 0.16 | 10.29 | 2037.3 | 117.1 | 427.7 | 236.2 | 1.726 | 113.005 |

| P+P | 359.16 | 0.60 | 0.04 | 0.12 | 0.07 | 0.16 | 10.16 | 2143.2 | 126.0 | 431.7 | 238.9 | 1.834 | 117.329 |

Notes:

- All Mineral Reserves have been estimated in accordance with the JORC code and have been reconciled to CIM standards as prescribed by the NI 43-101.

- Mineral Reserves were estimated using the following mining and economic factors: Open Pits:

- 5% dilution factor and 95% recovery were applied to the mining method;

- an overall slope angles of 43 degrees;

- The prices of Cu, Mo, Pb, Zn, Au and Ag are US$2.9/lbs; US$15.5/lbs; US$2.9/lbs; US$0.95/lbs; US$1,300/oz and $20/oz respectively

- an overall processing recovery of 88 - 90% for copper

Underground: - 10% dilution added to all Sub-Level Open Stoping;

- Stope recovery is 87% for Sub-Level Open Stoping;

- An overall processing recovery of 88 – 90% for copper.

- The cut-off grade for Mineral Reserves has been estimated at copper equivalent grades of 0.3% Cu (NSR) for the open pits and 0.45% Cu (NSR) for the underground mine.

- The Mineral Reserves are inclusive of the Mineral Resources

- Reserve Estimate by Mining One Consultants on 20th November 2013, and updated by Gerald Guo, P.Eng, a qualified person as defined by NI 43-101.

Click here for 2023 Q1 news release

LOOKING FORWARD:

Exploration

In 2023, Tibet Huatailong Mining Development Co., Ltd. plans to implement two geological exploration projects, namely detailed exploration of copper and lead project outside the current mining area of the Jiama Mine and prospecting of copper project in Bayi Farm, with a designed workload of 15,370 m of 20 holes for surface drilling, 37.31 km2 for geological prospecting, 26 km2 for soil sampling and 26 km2 for rock sampling.

Photos

|

|

|

|

|

|

|

|

|