Company Overview

China Gold International Resources Corp. Ltd. (“China Gold International” or “The Company”) and its subsidiaries (collectively referred to as the “Group”) is a gold and base metal mining company incorporated in British Columbia, Canada. The Company’s main business involves the operation, acquisition, development and exploration of gold and base metal mineral properties. The Company’s principal mining operations are the Chang Shan Hao Gold Mine (“CSH Gold Mine” or “CSH Mine” or “CSH”), located in Inner Mongolia Autonomous Region, China and the Jiama Copper-Gold Polymetallic Mine (“Jiama Mine” or “Jiama”), located in Tibet Autonomous Region, China. China Gold International holds a 96.5% interest in the CSH Gold Mine, while its Chinese joint venture (“CJV”) partner holds the remaining 3.5% interest. China Gold International began its trial gold production at the CSH Gold Mine in July 2007 and commercial production commenced on July 1, 2008. The Company acquired 100% interest in the Jiama Mine on December 1, 2010. Jiama hosts a large scale copper-gold polymetallic deposit consisting of copper, gold, molybdenum, silver, lead and zinc. The Jiama Mine commenced the commercial production of phase I and phase II in September 2010 and July 2018 respectively.

The Company is working to expand resources and reserves at its existing properties through exploration programs. The Company also has adopted a growth strategy focused on strategic acquisitions sourced from the international project pipeline of its principal shareholder China National Gold Group Co., Ltd. (formerly known as China National Gold Group Corporation) (“China National Gold”) and developing potential partnerships with other senior and junior mining companies.

| Combined Gold Reserve / Resource | |

|---|---|

| CSH and Jiama Gold | Contained Gold (M oz) |

| Proven / Probable Reserve | 2.53 |

| Measured / Indicated Resource(1) | 8.65 |

| Copper Reserve / Resource | |

|---|---|

| Jiama's Copper | Contained Copper (Thousand Tonnes) |

| Proven / Probable Reserve | 2123.57 |

| Measured / Indicated Resource (1) | 5543.61 |

(1) Inclusive of Mineral Reserves

(2) As of December 31, 2023 under NI 43-101

Production Overview

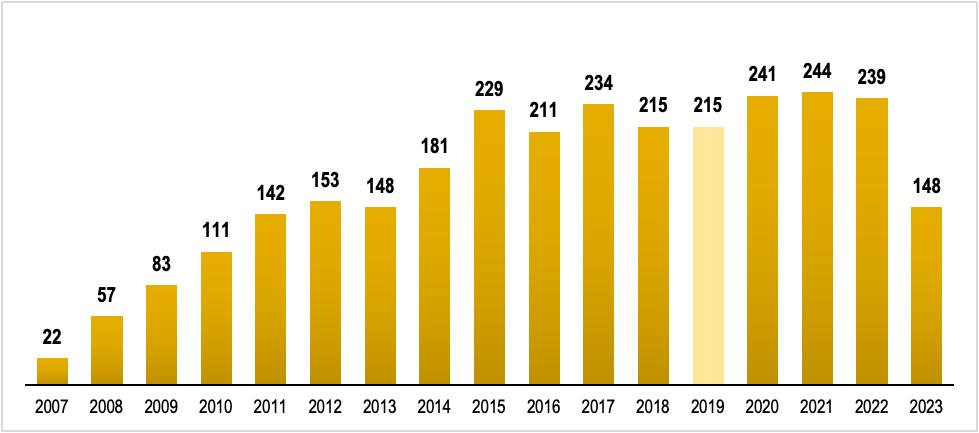

CSH&JIAMA COMBINED GOLD PRODUCTION (Koz)

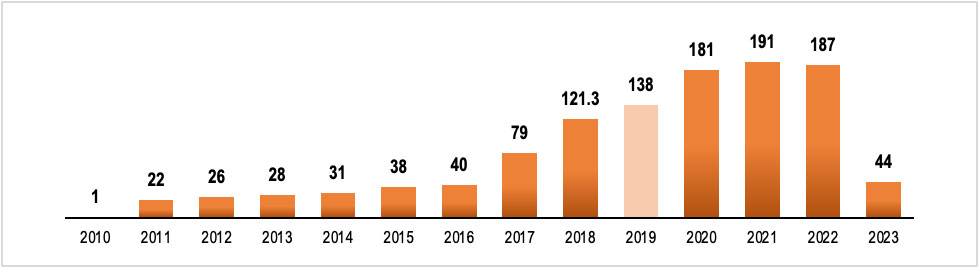

JIAMA COPPER PRODUCTION

(MM lbs)

HIGHLIGHTS

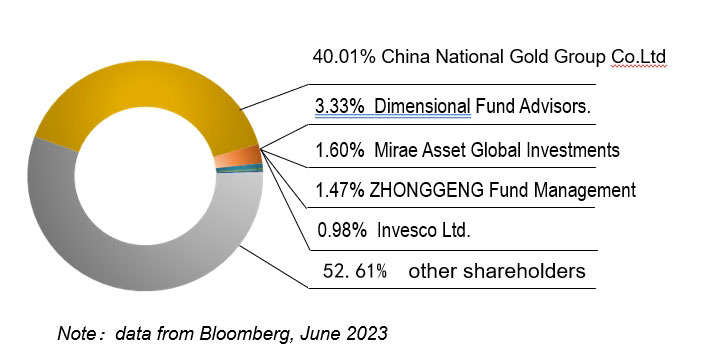

- SOLID STRATEGIC INVESTOR BACKING-Strong support from controlling shareholder: China National Gold Group Co., Ltd.

- Huge exploration potential providing significant resources and reserve upside

- INVESTMENT GRADE CREDIT RATING-August 2017: S&P reaffirmed the company’s BBB- long-term corporate credit rating

- ABILITY TO RAISE SIZABLE FINANCING AT LOW COST-2015-2017: Combined issued over US$1.1 billion bond

- BROAD INVESTOR REACH IN NORTH AMERICA AND ASIA-Dual listed in TSX and HKEX, eligible trading under the Shenzhen-Hong Kong Stock Connect

- HIGH STANDARD OF Corporate social responsibility (CSR) AND Health, Safety & Environment (HSE)

MAJOR SHAREHOLDERS

As of June 2023

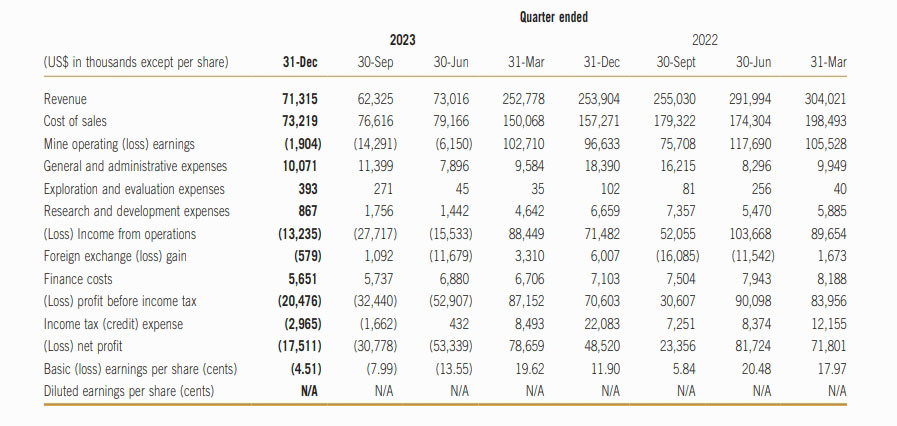

FINANCIAL PERFORMANCE

THE CSH GOLD MINE

One of the Largest Open Pit Gold Mines located in Inner Mongolia, China

- A conventional open-pit, heap-leach, gold-mining operation

- A large, bulk-tonnage, low-grade gold deposit

- Principle product: Gold dore bars with silver by-product

- Well-established basic infrastructure with excellent access to road and sufficient supplies of power, water and local labor force

- Processing capacity: 40,000 tpd

- Gold output(2023): 147,963 oz

Click here for more about The CSH Gold Mine

THE JIAMA COPPER-GOLD POLYMETALLIC MINE

One of the Largest Cu-Mo-Au-Ag-Pb-Zn Mining Operations located in Tibet, China

- With open-pit and underground mining operations

- A large, skarn-type mineralization dominated porphyry copper polymetallic deposit with well-developed hornfels-type mineralization located in the Gangdise Copper Metallogeny Belt

- Principle product: Copper with gold and silver by-product credits

- Infill drilling program completed in 2012 to upgrade resources confidence level and to optimize mine design and reserves

- Expected life of mine: 35 years

- Commercial production began in September 2010

- Mineral processing capacity: 50,000 tpd

- Copper production(2023): 44,203,779 pounds

Click here for more about The Jiama Copper-Gold Polymetallic Mine